Card News

NEWS

KOTI - Korea Transport institute-

# Korea’s infrastructure was mainly built in the 1970s and 1980s. Before the aging of infrastructure increases, the government is promoting the introduction of operation private highway project to enhance the effectiveness and ensure sustainability & management of aging infrastructure. Now, let’s examine at what should be considered for the successful implementation of the operational private highway project.

# What are operational Private investments?

It refers to a privately funded project in which the private sector finances, operates, and maintains government-owned facilities that have been constructed and completed through private investments, finance, and the use of public funds. This promotes facility improvement, efficient operation by introducing private investment into privately funded projects whose management and operation period has expired, and financial projects that are severely obsolete.

# The background of the operational private investment project is as follows.

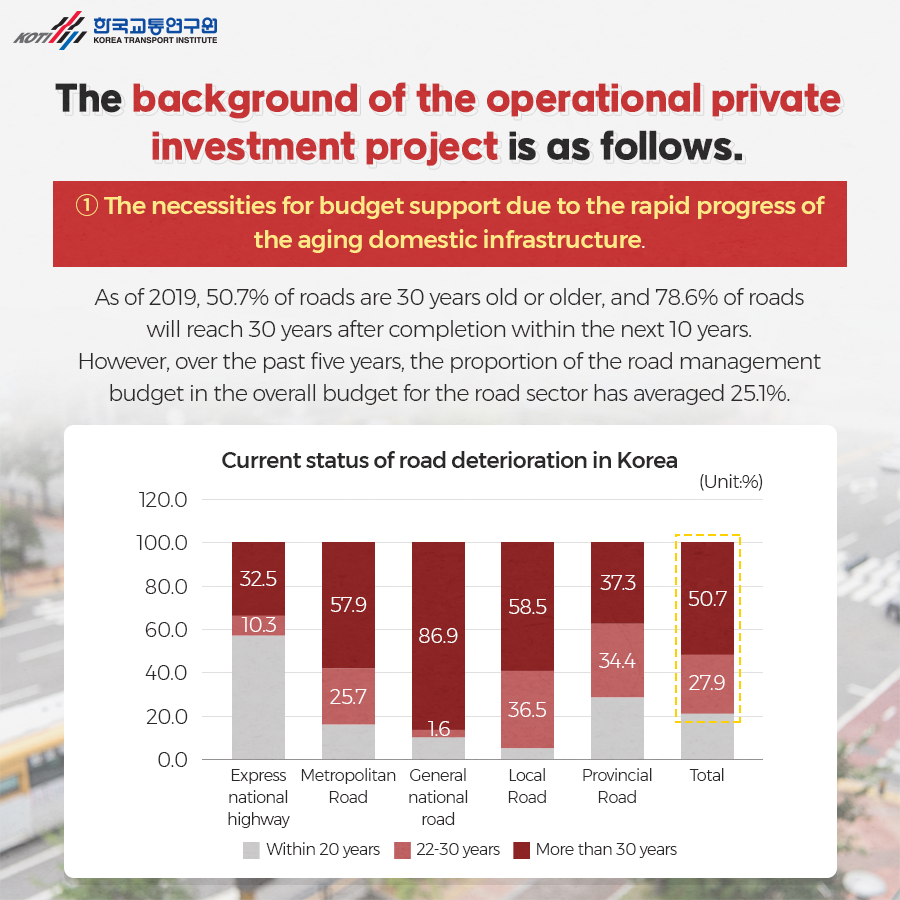

(1) The necessities for budget support due to the rapid progress of the aging domestic infrastructure.

-As of 2019, 50.7% of roads are 30 years old or older, and 78.6% of roads will reach 30 years after completion within the next 10 years. However, over the past five years, the proportion of the road management budget in the overall budget for the road sector has averaged 25.1%.

# (2) Changes in government management model due to aging infrastructure facilities.

1. Government-owned infrastructure facilities: Expiration of management and operation during financial operation of government owned private facilities.

2. Operational privately funded commercialization: Consideration of operating income and expenses, expansion and improvement costs, free use period, etc.

3. Recovery of management and operating value: Present values of future cash flow expected during the operating period.

4. Maintenance/improvement of new investments: Diversification of investment resources, Efficiency of financial management, and Improving service quality.

# Operational private investment projects are applied to privately funded projects that have expired and the government has ownership of the management and operational rights. Applicable targets are followed.

1. Among PPP (Public-private partnerships) facilities, projects that require capital for expansion or improvement, such as expansion, new IC establishment, and civil complaints, projects that require large repair costs during operations, and projects that must be integrated in terms of operational efficiency.

2. In the case of sales management and operational rights to alleviate financial burdens such as MRG and reducing usage fees.

3. In the case the construction is completed as a financial project and the conditions for conversion to a private investment project among financially operated facilities are satisfied.

# In an operation-type private investment project, if the rate of return is low, the value of the management and operation expenses increases. Factors affecting the Value of Administrative Rights. (Management and Operating Rights).

1. Operating income (ORi): Unlike the award under the agreement for the previous period, the new agreement income is determined by considering performance award and royalties.

2. Operating cost (OCi): Determination of appropriate operating costs based on existing operational performance, maintenance costs, and replacement costs considering obsolescence.

3. Expansion and retrofit cost (RCi): Expenses invested prior to starting operation as the cost of extension and retrofitting in accordance with an increase in the level of facility demand.

4. Free use period: 20 years is the default setting considering the operational efficiency and the service life of the facility.

5. Business income rate: The intermediate level between BTO and BTL returns is appropriate in consideration of the contingency risk from construction risks and long-term operation.

# Operational privately funded business is a structure in which a new business operator is designated after acquiring the relevant facility from an existing business operator, and the business operator pays the price for the management and operation rights to acquire free use rights for a certain period of operation. In addition, it is said that the performance evaluation standards applied to the BTL method will be introduced when the costs of facility operation are paid as a government payment.

# If so, what are the obstacles and solutions for operational private investments?

1. Sharing of Demand Risks: In order to stably manage aging facilities while activating operational private-sector projects, standard demand is presented based on performance, and the preliminary project operator decides to participate in the project after reviewing the standard demand.

2. Provision of opportunities for rational adjustment of operating costs: Management difficulties for privately invested corporations and operators due to increased operating costs due to strengthening working environment regulations, raising safety-related requirements, and changes in government policies.

➡ However, due to the principle of pre-determining business conditions, reasonable maintenance of operating costs is not achieved, and management pressure due to excess of operating costs may lead to deterioration of service quality and safety issues for users.

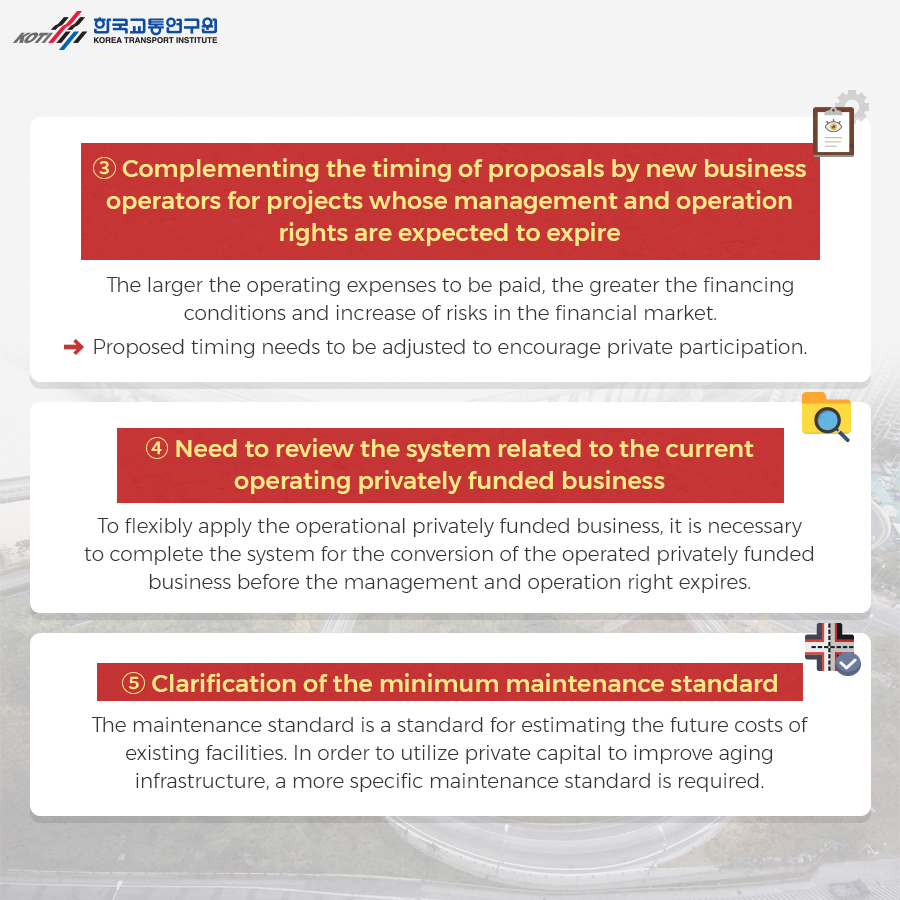

# 3. Complementing the timing of proposals by new business operators for projects whose management and operation rights are expected to expire: The larger the operating expenses to be paid, the greater the financing conditions and increase of risks in the financial market. ➡ Proposed timing needs to be adjusted to encourage private participation.

4. Need to review the system related to the current operating privately funded business: To flexibly apply the operational privately funded business, it is necessary to complete the system for the conversion of the operated privately funded business before the management and operation right expires.

5. Clarification of the minimum maintenance standard: The maintenance standard is a standard for estimating the future costs of existing facilities. In order to utilize private capital to improve aging infrastructure, a more specific maintenance standard is required.

# Recently, as a model change is required for aging infrastructure facilities, the government is pushing for the introduction of an operational private sector method. Structural aspects are important for the successful implementation of the operating private road project, but it is also important to prepare incentives for the newly introduced private road project. Therefore, I hope that the policies related to the operation-type private investment projects from the private perspective will be realized and applied.

* This card news was produced after partially modifying and supplementing the Private Highways Insight Brief 2022 Vol.1 No. 1 of the Korea Transportation Institute.